Improving the performance of organisations with a vested interest in capital projects.

Whether a client organisation, or part of the supply chain, if a business has a vested interest in capital projects, the outcome of such projects can have a significant impact to the business’ strategic objectives and overall balance sheet.

This is our focus. We understand how capital projects’ performance translates into business performance and we support investor, client and contractor organisations in achieving their financial and non-financial goals.

Business strategic objectives

and financial performance

Business operational

performance

Performance of portfolio of

capital projects

Business Case, planning and

delivery of capital projects

Operating Model Review / Transformation, Portfolio / Project Assurance and Project Management

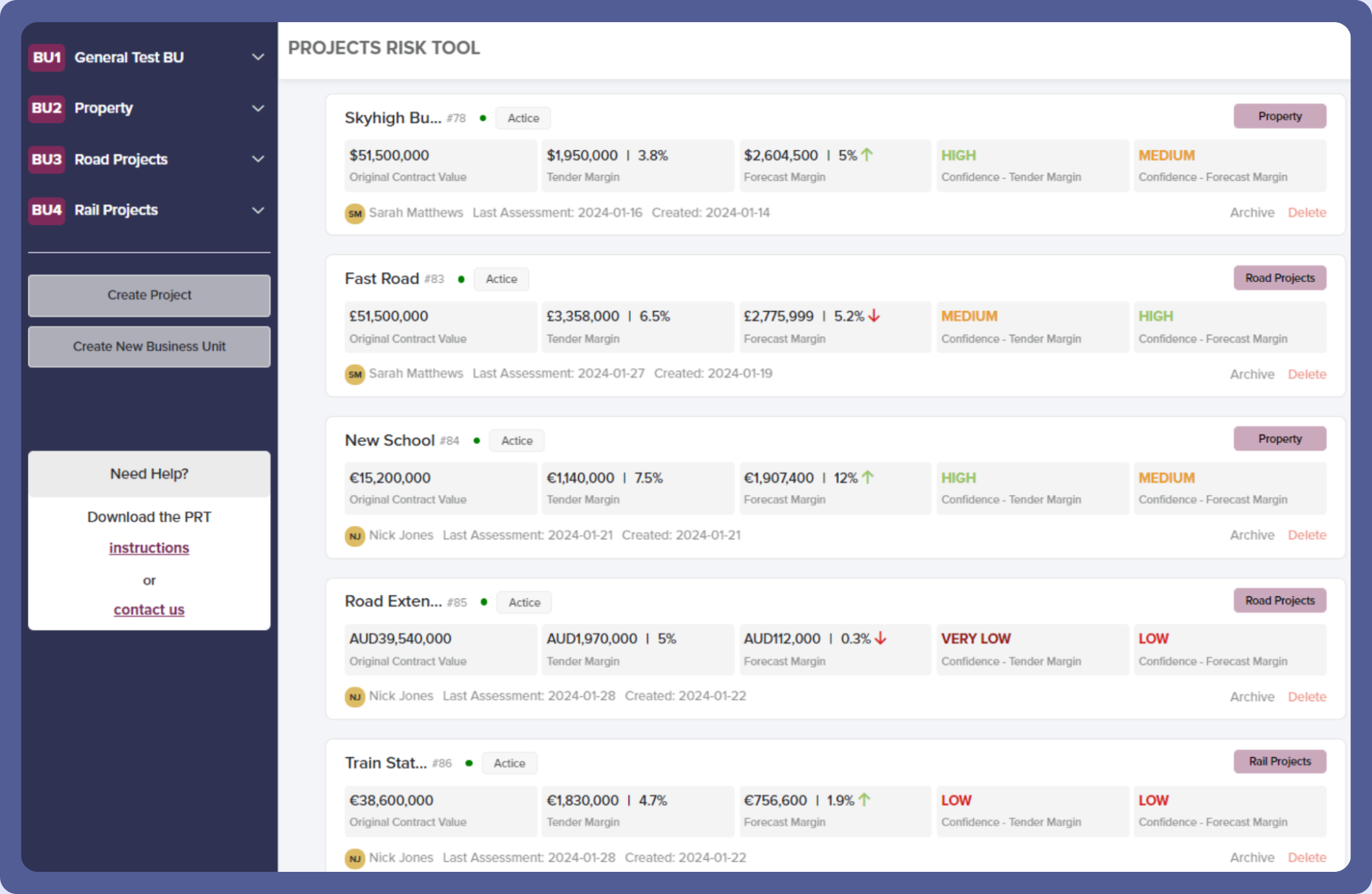

Note: This level of service is significantly enhanced for contractor organisations through the provision of the Projects Risk Tool.

Note: This level of service is significantly enhanced for contractor organisations through the provision of the Projects Risk Tool.

Confidence

- Revenue Confidence: It is critical that assumptions used to develop the revenue to be generated are properly understood as these can materially impact the business case of a project.

- Cost Confidence: Capital projects are expensive and a relatively small cost increase can have a significant impact on the project returns. It is hence important that the cost feeding the business case is robust and is based on solid assumptions.

and their Objectives

Confidence

- Once the project has been initiated, it is crucial that it can be delivered in line with the Business Case and as such appropriate controls and governance will be required to ensure this happens.

and their Objectives

Our Approach

We believe that we can help organisations best by providing support that adapts to the business needs and by understanding how different markets operate.

To that end, we collaborate with consulting partners who are experts in different subject matters (e.g. strategy, operating model, project management) and industries, and who are spread across Europe and in particular in the UK, Germany, Holland, Italy and Greece.

An engineer by background and a certified Project Manager, Alex has worked over the last 17 years in a diverse set of roles across a range of industries.

He has worked as a management consultant for Canfield Consulting and two major UK consultancies (Deloitte and KPMG). There he has led multiple projects, such as optimising the operating model of contractor organisations and the management of their portfolio of projects, setting up processes and providing assurance to multi-bn transport programmes, supporting energy industry clients better understand the confidence in achieving their business case objectives, as well as supporting public sector clients in their procurement approach for getting multi-million capital projects progressed.

Prior to working as a consultant, Alex worked as a project manager for a utility (RWE) at the development of a multi-bn offshore wind farm project in the UK, and as an engineer for a contractor (Kier) at the construction of an LNG terminal project.

This breadth of experience at both a strategic level but also through hands on involvement in the management of programmes and projects across different sectors and client types provides Alex with a holistic view of capital projects and the challenges faced across all key stakeholder groups.

PRT is an online software tool which supports the identification of financial risks within construction projects. It aims to maximise portfolio profitability and improve financial forecast accuracy and expectations management.

Contact Us